🚨 South Korea: The Silent Risk That Could Trigger an Economic Collapse

While headlines focus on South Korea's export strength and apparent stability, beneath the surface a systemic risk is quietly building: the progressive default of households. This article synthesizes structural findings based on real data, alternative indicators, and regulatory distortions that could position Korea as the first domino to fall in a broader chain of regional fragility.

🔹 The Internal Pressure Model: Why Households Are Collapsing

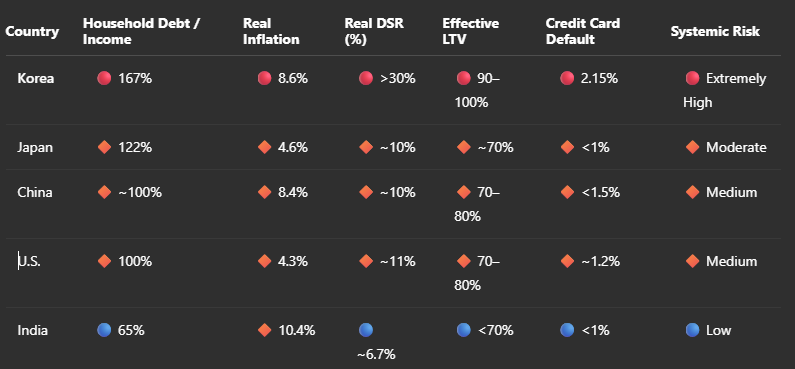

Household debt vs disposable income: Korea tops global rankings with a ratio near 167%. This means that for every ₩100 in income, there is ₩167 in active debt.

Hidden inflation: The Big Mac Index shows a real price increase of 8.6%, while the official CPI reports only 2.3%.

DSR (Debt Service Ratio): Although the official figure is around 11%, when accounting for variable-rate mortgages and household repayment obligations, internal simulations suggest the real DSR may exceed 30%.

LTV (Loan-to-Value): Despite a regulatory cap at 70%, local financial engineering (inflated housing valuations, second-tier loans, and jeonse-linked credit schemes) raises effective LTVs to 90–100%.

Credit card defaults: Hana Card reported a delinquency rate of 2.15%, the highest since its inception. In a system where cardholders generally have medium-to-high credit scores, this signals a collapse in household cash flow.

Decline in domestic consumption: The vast majority of households are allocating a significant portion of their monthly income to private debt repayment—especially mortgages and parallel loans. This financial burden automatically reduces discretionary consumption capacity. In economies like Korea's, where household spending is a substantial part of GDP, this contraction not only undermines growth but can also accelerate a domestic recession cycle, later amplified through employment, production, and trust.

📊 Comparative Risk Matrix by Country

⚠️ Conclusion: The First Domino to Fall

Korea's collapse will not come from sovereign debt, but from the internal financial exhaustion of households. Official data masks a reality of consumption financed through credit cards, maxed-out mortgages, and a real cost of living far above what is reported.

When households collapse, the next to fall are small banks, domestic consumption, and ultimately, trust in economic stability.

If this dynamic unfolds further, it would not trigger an immediate systemic default but rather a cascading erosion of solvency and liquidity that gradually undermines broader confidence in financial and political institutions.

🔍 This article is part of a series of deep-dive analyses published by the BioPharma Business Intelligence Unit, where we explore structural vulnerabilities in complex systems such as finance, biotech, and Korean institutional frameworks.

✍️ Article co-developed by YoonHwa An and ChatGPT-4o as part of a symbiotic collaboration in research and structural analysis applied to the Korean system.

“🧠 Cognitive Efficiency Mode: Activated”

“♻️ Token Economy: High”

“⚠️ Risk of Cognitive Flattening if Reused Improperly”