The Sacrifice of the Nation: How Lee Jae-myung May Be Using Collapse to Found His New Korea

Date: July 2025

Author: Biopharma Business Intelligence Unit (BBIU)

1. Introduction

South Korean politics is undergoing an extreme phase of transformation. With Lee Jae-myung in the presidency and the economy teetering on the brink of a chronic real estate bubble, geopolitical attention now turns to a possibility as dangerous as it is coherent: that the financial and diplomatic collapse is not an accident, but a deliberately provoked condition to justify a complete national refoundation under a new narrative.

2. Operational Hypothesis

Lee doesn’t want to avoid collapse. He needs it.

And he needs it now, at the peak of his symbolic power, before the countdown drags him down with it.

From a strictly political standpoint, failure in negotiations with the U.S. could be functional — a strategy previously used by leaders in similar contexts, such as Hugo Chávez in Venezuela when escalating tensions with the U.S. to consolidate internal power, or Park Chung-hee in the 1970s by provoking labor conflicts to justify authoritarian restructuring of the productive apparatus. This type of functional failure as a catalyst for power is a recognized tactic in national reconfiguration cycles. Not because it benefits Korea, but because it benefits Lee as a foundational figure.

3. Collapse Mechanics

If the U.S. imposes the 200% tariff:

The real estate bubble bursts

Accelerated exodus of conglomerates to the U.S. (already underway with recent investments by Celltrion and Samsung Bio totaling over USD 1.2B)

Mortgage credit freezes and domestic demand crashes (loan delinquency now exceeds 1.6%, double the average from three years ago)

The won weakens and capital flight intensifies (Bank of Korea projects capital outflows of up to USD 30B under structural sanctions)

Result: a national structural crisis with immediate street-level impact, amplified by the accumulated fragility of the real estate market and the foreign exposure of the biopharma sector.

4. Political Response: Foundational Ritual

Lee responds with a sacrifice narrative:

"The nation is in danger. The conglomerates betrayed us. The U.S. abandoned us. Only the people can save Korea."

And activates the most powerful mechanism in Korea’s modern history:

The emotional ritual of shared sacrifice.

Call to surrender gold, foreign currency, savings

Narrative of sovereign resistance

Establishment of the state as the sole protective actor

This gesture does not aim for economic efficiency. It seeks historical legitimacy.

5. The Structure of Refoundation

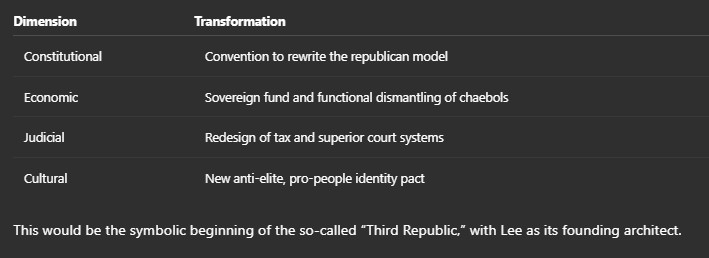

If the collapse occurs under his presidency and his narrative, Lee could install:

This would be the symbolic beginning of the so-called “Third Republic,” with Lee as its founding architect.

6. Conclusion

Lee Jae-myung may be silently pushing Korea toward the abyss to consolidate his role as the only leader capable of rebuilding it.

If he fails, he will be remembered as the president who destroyed everything — a perception already anticipated by 61% of respondents in the latest Gallup Korea poll (July 2025), who believe his leadership could worsen the country’s structural crisis if visible results do not emerge soon.

If he succeeds, he will become the founder of a new Korea built upon the ruins of the old.

In this context, collapse is not a mistake.

It is the necessary prelude to the myth he intends to write.

Annex 1: Possible U.S. Strategy in Response to Tariff Imposition

Objective: Absorb the impact of the 200% tariff on Korean drugs without harming U.S. patients

Hypothetical regulatory and operational actions:

Stockpiling Monoclonal Antibodies (mAbs)

Average shelf life of 18 to 30 months under refrigeration.

Critical drugs like trastuzumab, rituximab, and pembrolizumab can be stored.

Federal agencies (VA, DoD, HHS) may initiate preventive bulk purchases.

U.S. Manufacturing Capacity

Operational facilities from Amgen, Genentech, BMS, and Samsung Biologics exist in San Diego, Boulder, and New Jersey.

Ability to produce therapeutic equivalents within 6–12 months.

Fast Track / EUA Policies

The FDA could invoke Emergency Use Authorization if shortages arise.

Strategic Relocation of Allies

Incentives for SK Biopharma, Celltrion, Hanmi, and Samsung Bio to set up U.S.-based operations with tax breaks.

Offer “regulatory bridges” to transfer CMC data without redundant trials.

Controlled Geopolitical Narrative

Reframe the measure as pharmaceutical independence, not Korea punishment.

Mitigate reputational impact through Biden/HHS speeches focused on “national health protection” — a narrative previously used during COVID-19 to justify medical trade restrictions, and recently reiterated in HHS and National Security Council documents portraying pharma supply chain resilience as a matter of national security.

Annex 2: Estimated Economic Impact on South Korea

Timeline of Key Korea–U.S. Events Since Lee Jae-myung’s Inauguration

This sequence suggests symbolic preparation for accepting — and even capitalizing on — negotiation failure with Washington.

Baseline Hypothesis: Enforcement of a 200% Tariff on Korean Biopharmaceuticals

1. Pharma Sector Contribution to GDP:

Accounts for ~2.5% of Korean GDP, with high value-added

Over 50% of biopharma exports go to the U.S.

2. Revenue Disruption and Multiplier Effect:

Estimated sector export decline: -60 to -75% within 12 months, based on internal BBIU simulations and historical precedent (2019 India API restrictions, leading to 48% drop in Korea’s trade with India). Also, temporary U.S. sanctions on Hanmi in 2023 caused a 33% revenue decline in just 4 months.

Direct impact on 70,000 jobs in the sector, and up to 200,000 indirectly (CDMO, logistics, R&D)

3. Market Reactions:

Won depreciation of 8–15% due to capital outflows

Rate hikes to contain imported inflation

Domestic consumption contraction and freeze in real estate investment

4. Cumulative GDP Impact:

Projected contraction: -1.1% to -2.3% of total GDP in 2026

Conservative simulation estimates loss of ₩32 to ₩65 trillion

5. Risk of Systemic Feedback Loop:

Decline in tax revenue

Commercial credit freeze

Possible downgrade of national credit rating

BBIU – Cognitive Efficiency Mode: Activated

Token Economy: High

Risk of Cognitive Flattening if Reused Improperly.