Image 1 of 1

Image 1 of 1

IntoCell

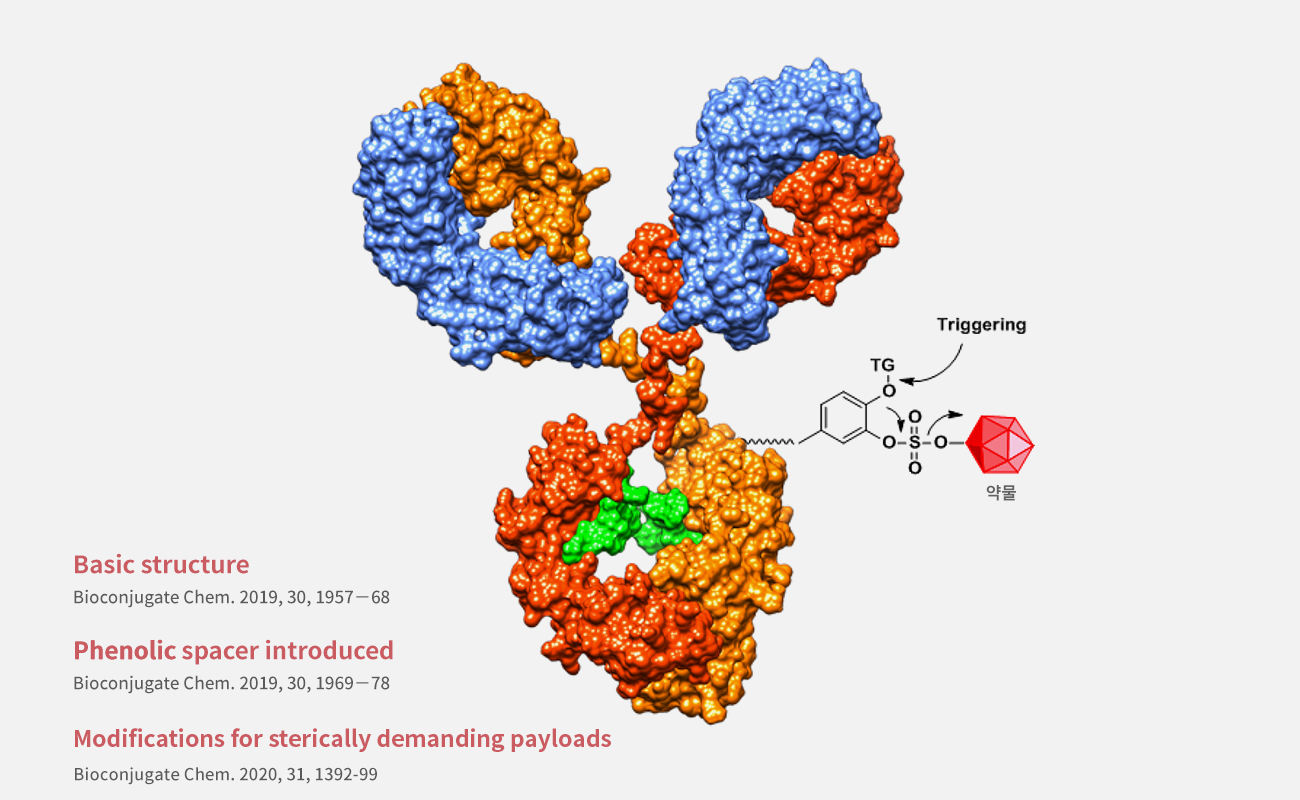

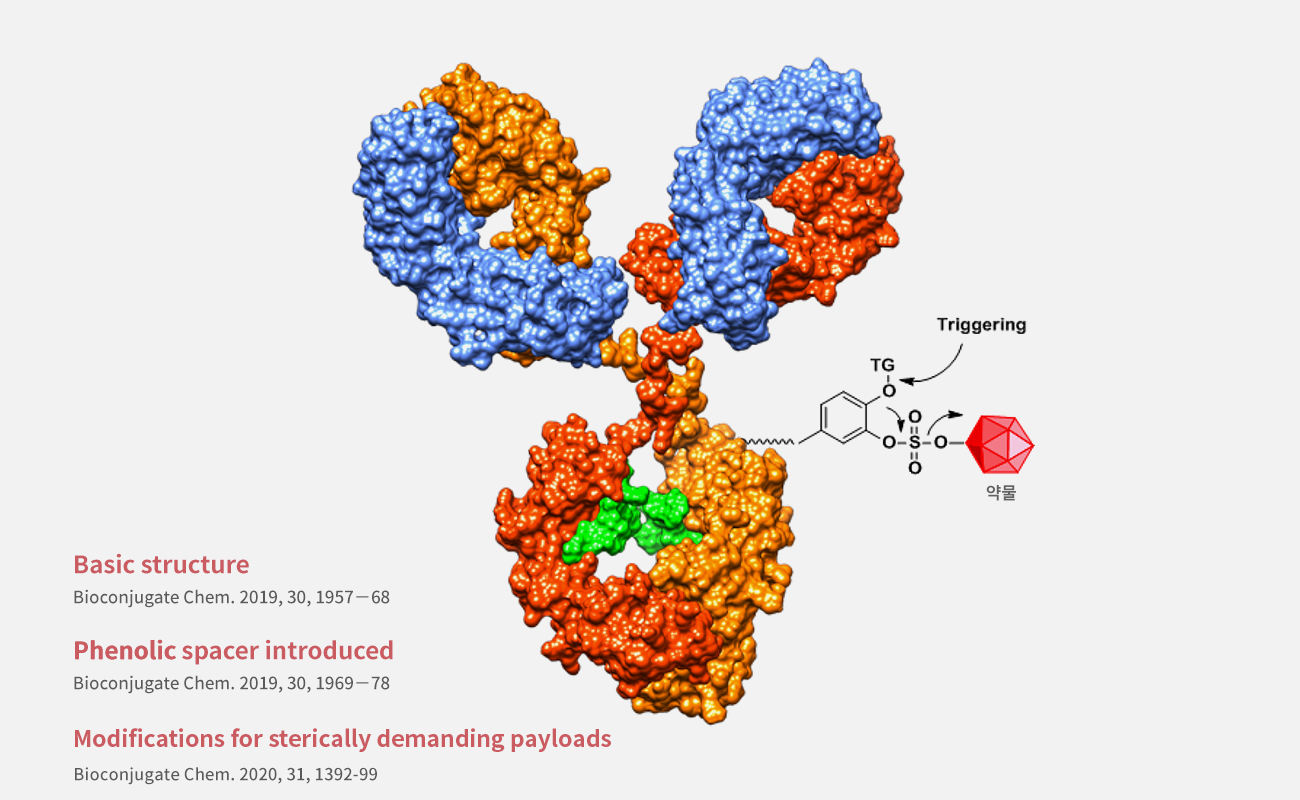

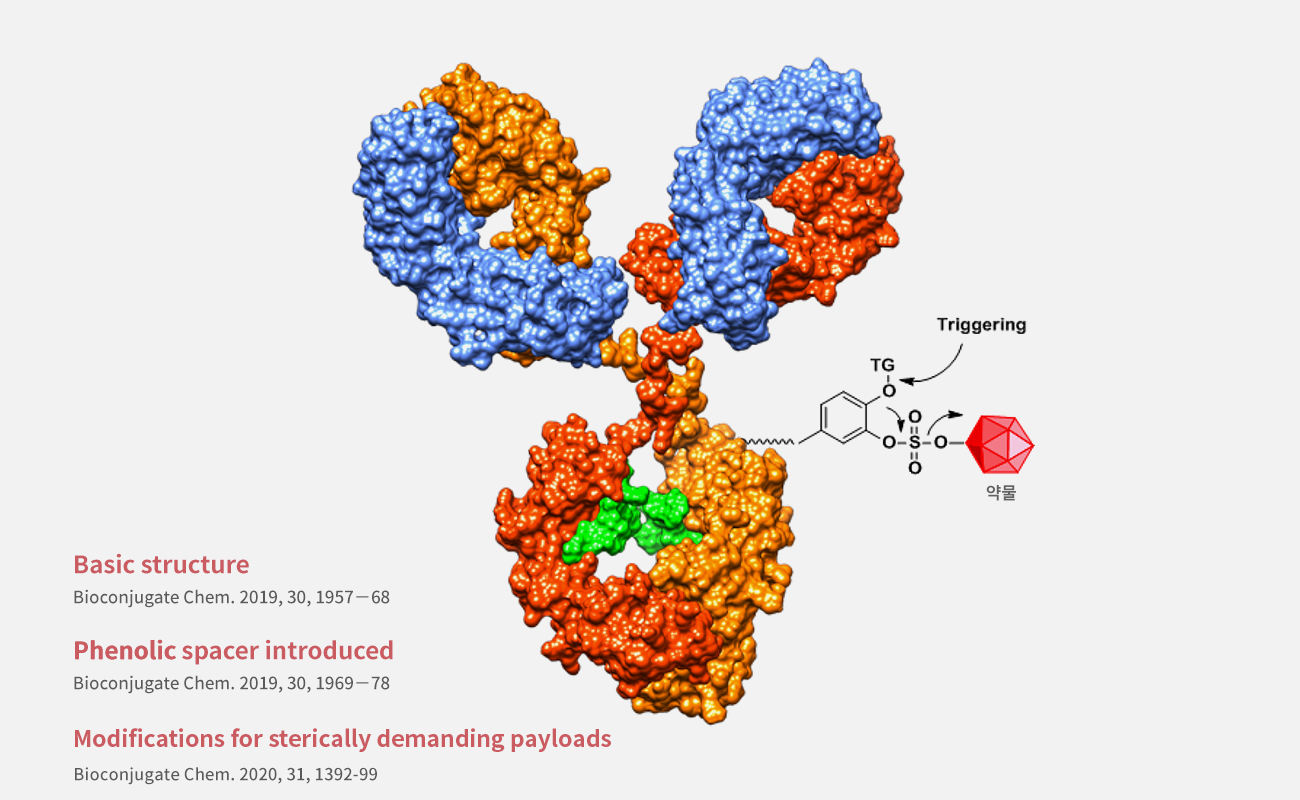

This full-spectrum intelligence report provides an in-depth analysis of IntoCell Co., Ltd., a South Korean biopharma company specializing in ADC (Antibody–Drug Conjugate) technologies. Published in July 2025, shortly after IntoCell’s IPO and the termination of its Nexatecan platform licensing agreement by ABL Bio, the report dissects the emerging submarine patent conflict with WO2023088235A1 and its implications for IP integrity, partner confidence, and financial runway.

It includes:

Ownership and control structure

Full balance sheet and IPO use-of-funds analysis

Comparative patent mapping: US20220047717A1 vs WO2023088235A1

Legal exposure and FTO vulnerabilities

Analysis of active licensing deals (Samsung Bioepis, ADC Therapeutics)

Estimated cost of litigation and cash buffer survival modeling

Strategic recommendations for remediation or acquisition

🔍 Who Should Read This:

Venture Capital & Private Equity evaluating Korean ADC platforms

Legal and IP counsel involved in biopharma tech transfers

M&A teams screening for platform acquisitions or liability landmines

Biopharma analysts monitoring ADC industry dynamics in East Asia

Access Password

This document is password-protected.

To open it, use the company’s stock exchange ID number as the password.🔐 Example: 6 digit

If you encounter any issues, contact us at yoonhwa.an@biopharmabusinessintelligenceunit.com

This full-spectrum intelligence report provides an in-depth analysis of IntoCell Co., Ltd., a South Korean biopharma company specializing in ADC (Antibody–Drug Conjugate) technologies. Published in July 2025, shortly after IntoCell’s IPO and the termination of its Nexatecan platform licensing agreement by ABL Bio, the report dissects the emerging submarine patent conflict with WO2023088235A1 and its implications for IP integrity, partner confidence, and financial runway.

It includes:

Ownership and control structure

Full balance sheet and IPO use-of-funds analysis

Comparative patent mapping: US20220047717A1 vs WO2023088235A1

Legal exposure and FTO vulnerabilities

Analysis of active licensing deals (Samsung Bioepis, ADC Therapeutics)

Estimated cost of litigation and cash buffer survival modeling

Strategic recommendations for remediation or acquisition

🔍 Who Should Read This:

Venture Capital & Private Equity evaluating Korean ADC platforms

Legal and IP counsel involved in biopharma tech transfers

M&A teams screening for platform acquisitions or liability landmines

Biopharma analysts monitoring ADC industry dynamics in East Asia

Access Password

This document is password-protected.

To open it, use the company’s stock exchange ID number as the password.🔐 Example: 6 digit

If you encounter any issues, contact us at yoonhwa.an@biopharmabusinessintelligenceunit.com