🟡 U.S.–EU Mega Trade Pact: Deal or Capitulation?

📅 Date

July 28, 2025 (based on CNN coverage from April 23, 2025, updated recently)

✍️ Author and Source

Anna Cooban, CNN (London bureau)

🧾 Summary (non-simplified)

President Donald Trump announced a landmark trade framework with the European Union, hailed by him as the “biggest deal ever.” The agreement sets a 15% tariff on most EU imports—lower than previous threats (30%) but still substantially above pre-Trump second-term levels (~1.2%). The EU has agreed to invest hundreds of billions in the U.S. and to increase purchases of U.S. energy exports.

While von der Leyen framed the deal as stabilizing for transatlantic business, numerous EU leaders criticized it as a “capitulation,” citing asymmetry and strategic imbalance. Critics included French PM François Bayrou, Dutch PM Dick Schoof, German Chancellor Friedrich Merz, Hungarian PM Viktor Orbán, Belgian PM Bart De Wever, and trade committee chair Bernd Lange. International law expert David Collins called it "a humiliating capitulation."

The article reveals deep intra-European dissatisfaction, portraying the pact less as bilateral success and more as a forced concession under pressure from the U.S. tariff regime.

⚖️ Five Laws of Epistemic Integrity

1. ✅ Truthfulness of Information — 🚦Green

All factual content aligns with verifiable statements and public diplomatic positions. No factual distortions or speculative inflation by the author. Trump’s quotes, tariff data, and EU leaders’ reactions are accurately presented.

2. 📎 Source Referencing — 🚦Green

Named quotes from 7 high-level officials, plus one academic expert. Each public figure is identified by name and institutional role. Original sources are clearly cited (e.g., X posts, podcasts, public statements, CNN interviews).

3. 🧭 Reliability & Accuracy — 🚦Yellow

While major leaders are quoted, the article heavily relies on reactions from national figures without institutional context from the European Commission or economic modeling. No formal EU legal analysis of the deal’s implications is included.

4. ⚖️ Contextual Judgment — 🚦Yellow

The article frames EU reactions as capitulatory but doesn’t explore deeper strategic calculations (e.g., EU internal political constraints, global trade fragmentation, or energy dependency). Absence of industrial or macroeconomic input limits judgment range.

5. 🔍 Inference Traceability — 🚦Yellow

Conclusions like "capitulation" are presented through expert and official opinions but lack a multi-angle trace of trade terms, negotiation alternatives, or historical precedent. Risk of inferring too much from political disappointment without structural decomposition.

📚 Referenced Names and Sources

👥 Political Figures:

Donald J. Trump – President of the United States

Ursula von der Leyen – President of the European Commission

François Bayrou – Prime Minister of France

Dick Schoof – Prime Minister of the Netherlands

Friedrich Merz – Chancellor of Germany

Viktor Orbán – Prime Minister of Hungary

Bart De Wever – Prime Minister of Belgium

Bernd Lange – Chair, European Parliament Trade Committee

🎓 Academic Expert:

David Collins – Professor of International Economic Law, City St George’s University of London

📰 Media Source:

CNN, Anna Cooban – “Where Trump sees the ‘biggest deal ever,’ Europe sees capitulation”, April 23 / July 28, 2025

Getty Images, AFP, Reuters (image and quote references)

🧠 Summary – Professor David Collins

Position: Professor of International Economic Law at City, University of London.

Expertise: World Trade Organization law, foreign investment, and digital trade regulation.

Institutional Affiliations: Associated with the Macdonald-Laurier Institute, a Canadian think tank known for pro-market, classical liberal economic views.

Ideological Tendencies:

Advocates for free trade, legal predictability, and strong investor protections.

Critic of protectionist measures like digital services taxes or arbitrary tariffs.

Emphasizes the need for institutional balance and strategic parity in trade negotiations.

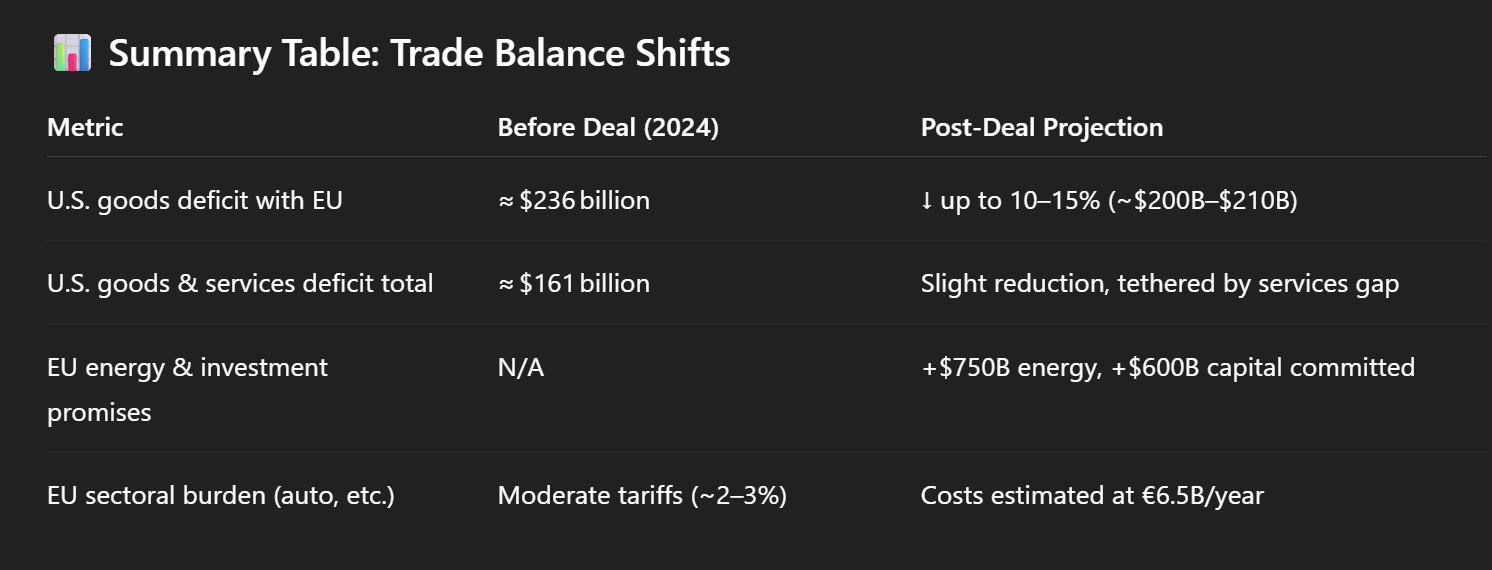

🔄 Projected Change in Trade Balance After the Trump–EU Deal

🧾 Before the Deal (2024 baseline)

U.S. imports from EU: ≈ $606 billion

U.S. exports to EU: ≈ $370 billion

Goods deficit: ≈ $236 billion in favor of the EU.

Including services totals, the U.S. had an overall goods & services deficit with the EU of approx. $161 billion MarketWatch+2Deutsche Welle+2PBS+2Bruegel+1The Guardian+1.

🧠 Post‑Deal Dynamics

⚙️ U.S. Trade Position

The 15% tariff on EU exports (across ~70% of product categories) is projected to reduce Europe’s export volume to the U.S., thereby cutting the U.S. goods deficit by an estimated 10–15% according to trade economists The Guardian+1Deutsche Welle+1.

EU commitments to purchase $750 billion in U.S. energy products and investments totaling $600 billion over the next 3 years add an additional lever of capital and export volume inflow, partially offsetting the persisting structural deficit in goods Deutsche Welle+8MarketWatch+8New York Post+8.

🇪🇺 EU Impact

While overall exports to the U.S. remain substantial, the increased tariff burden—especially on autos, machinery, and chemicals—will erode profit margins by ~€6.5 billion annually in the German auto sector alone The Guardian+4Deutsche Welle+4Deutsche Welle+4.

Analysts estimate that the 25% U.S. tariff cut to 15% still represents a six-fold increase over pre-Trump levels (~2.5%), generating inflationary pressure across EU exports ft.com+15Deutsche Welle+15euronews.com+15.

🇩🇪 Germany

2024 U.S. goods trade deficit: ~$84.8 billion (in favor of Germany) The TimesEuropean Commission+2Bureau of Economic Analysis+2United States Trade Representative+2

Germany remains the EU’s largest exporter to the U.S., with record bilateral trade at €236 billion in 2023 WikipediaWikipedia.

Post-deal projection: Tariff reduction to 15% on autos/materials is expected to reduce export volumes modestly. In May 2025, U.S. imports of German goods fell by 7.7% following pre-deal stockpiling, yet Germany’s trade surplus rose to €18.4 billion Reuters.

🇫🇷 France

2024 U.S. goods trade deficit: ~$16.4 billion Bureau of Economic Analysis

While smaller in scale, France’s exports to the U.S. include luxury goods, aerospace, pharmaceuticals—sectors vulnerable to tariff shifts.

Post-deal expectation: Reduced export demand and margin erosion from tariff impact, though full quantitative estimates not yet public.

🇫🇷 Hungary, 🇧🇪 Belgium

No direct U.S. bilateral data available from available sources. However, these countries operate largely within EU trade frameworks and are indirectly affected.

Belgium’s exports and imports reflect broader EU goods surplus (€13.1 billion in May 2025) wits.worldbank.org+5destatis.de+5Wikipedia+5European Commission.

Hungary’s trade is heavily EU-centric; any shift in overall EU trade flows will influence Hungarian export dynamics, especially in industrial sectors Wikipedia.

🧩 Structured Opinion — BBIU Strategic Analysis

The July 2025 U.S.–EU agreement, lauded by President Trump as the “biggest deal ever,” reflects a strategic asymmetry—one where U.S. tariff threats were systematically converted into concessions, capital inflows, and long-term industrial leverage. From a structural lens, the accord marks a shift from rules-based reciprocity to leverage-based compliance.

1. EU Fragmentation and Psychological Submission

European leaders, particularly François Bayrou (France), Viktor Orban (Hungary), and Bart De Wever (Belgium), framed the deal as submission rather than negotiation. These reactions are not just rhetorical—they signal a deeper structural fracture within the EU’s strategic posture. While Germany pragmatically accepted the deal as a relief (due to export reliance), other members interpreted it as a capitulation to power politics—a recognition that the bloc is no longer able to act as a unified economic counterweight.

2. Economic Repricing of German Industrial Power

Germany, the primary exporter to the U.S., now faces a recalibration of its automotive and machinery sectors. While the tariff was reduced to 15%, the cumulative impact of uncertainty, administrative friction, and relative pricing shifts will gradually erode its competitive edge. What appears as "stability" masks a strategic weakening of Germany’s export engine, with long-term implications for its surplus-driven growth model.

3. Narrative Engineering vs. Economic Outcome

Ursula von der Leyen presented the agreement as one of “predictability,” yet the symbolic structure favors the U.S.—which imposed a frame of instability and then offered relief in exchange for capital and compliance. The Trumpian negotiation model transforms volatility into strategic advantage, extracting commitments while preserving unilateral tariff power.

4. France, Belgium, Hungary: Powerless Resistance

For countries like France, whose trade exposure to the U.S. is less than Germany's but symbolically significant, the result is a feeling of abandonment. The use of rhetoric like “dark day” and “featherweight vs. heavyweight” reveals a collective loss of narrative control and growing internal dissent within the EU about how to handle U.S. pressure. Their economies will not collapse, but the erosion of symbolic agency is unmistakable.

5. Symbolic Inversion: From EU Normative Power to Economic Appeasement

This deal finalizes a decade-long inversion: the EU, once seen as the normative superpower of trade (championing rules, environmental standards, and balanced governance), is now playing defense. The appeasement dynamic—tariffs accepted in exchange for short-term relief and access—reveals a decline in strategic optionality.

🎯 Final Integrity Verdict:

This trade agreement is structurally favorable to the United States. The EU gains temporary breathing room, but at the cost of long-term strategic autonomy and internal cohesion. Germany adapts pragmatically; France and others resist symbolically—but all recalibrate under asymmetric pressure. The symbolic frame has shifted: “appeasement” replaces “partnership.”