From Coercion to Conditional Compliance: China’s Export-Control Retreat and the U.S.–Allies Strategic Pivot (Oct 9 – Nov 9, 2025)

Between October and November 2025, China attempted to weaponize its dominance over critical materials — and discovered the limits of coercive leverage in a coordinated global system. The one-year suspension of export controls on gallium, germanium, antimony, and rare earths marks not reconciliation but exhaustion: Beijing traded geopolitical pressure for domestic liquidity.

For the United States, the timing was perfect. As the Western holiday purchase cycle accelerated, Washington gained both cheaper imports and a disinflationary narrative. The Xi–Trump truce transformed China’s leverage into a timed concession — a one-year bridge until U.S. and Australian refining capacity reaches scale in late 2026.

The outcome is asymmetrical yet coherent: China preserved liquidity; the United States captured time. What appears as a tactical truce is, in structural terms, the redefinition of economic sovereignty through control of industrial calendars.

The Quantico Tamiz – How the New York Times Confirmed BBIU’s October Projection

On November 7 2025, The New York Times reported that Defense Secretary Pete Hegseth had “fired or sidelined at least two dozen generals and admirals over the past nine months.”

This revelation confirms what BBIU projected more than a month earlier, in its October 3 analysis “The Quantico Assembly: Trump’s Silent Tamiz of the U.S. Generals.”

What mainstream media now describes as a “purge” was identified by BBIU in advance as a filtration mechanism — a deliberate, data-driven process of ideological alignment within the U.S. military command.

The subsequent removal of roughly twenty senior officers validates BBIU’s structural forecast that the September 30 Quantico meeting marked the beginning of a controlled reconfiguration of military power under the Trump-Hegseth axis.

BBIU’s foresight is now independently confirmed: Quantico was not a motivational gathering, but the first stage of an institutional purge disguised as reform.

The Xi–Trump Summit: Tactical Truce, Structural Submission

The Busan summit between Donald Trump and Xi Jinping marked a temporary stabilization in U.S.–China relations but confirmed a deeper asymmetry in power and intent.

Under the appearance of cooperation, Washington achieved three objectives: regaining agricultural leverage, securing rare-earth supply for one year, and preserving full control over semiconductor restrictions.

Beijing, constrained by deflation, youth unemployment, and capital flight, accepted the truce as a survival measure rather than a strategy.

The one-year duration of the rare-earth clause synchronizes perfectly with the U.S.–Australia industrial corridor’s completion, allowing Washington to reassert dominance once independence is achieved.

Technological containment remains untouched; economic relief is symbolic.

Busan, therefore, was not diplomacy—it was orchestration: a handshake masking a hierarchy, a truce that encodes submission.

Annex A – Technical and Industrial Evidence: Semiconductor Controls and the ASML Incident

Annex B – The Rare-Earth Corridor and the Ten-Point Tariff Illusion

Annex C – Internal China: The Causes and Conditions Behind the Busan Concession

Nuclear Submarines for South Korea: Strategic Authorization or Symbolic Extraction?

On October 29, 2025, Donald Trump announced that the United States authorizes South Korea to construct a nuclear-powered submarine. The approval was framed as part of a larger economic package: tariff reduction from twenty-five to fifteen percent, mandatory purchases of U.S. liquefied natural gas, and a South Korean investment commitment of three hundred and fifty billion dollars. President Lee Jae-myung emphasized that Seoul does not seek nuclear-armed submarines, but conventionally armed vessels powered by nuclear propulsion.

The announcement breaks a long-standing U.S. taboo on transferring naval nuclear technology to non-nuclear-weapon states. For South Korea, the appeal lies in valorizing its vast stockpile of spent fuel, reducing dependence on imported uranium rods, and projecting parity against a nuclear-armed North. For the United States, the core logic is industrial: anchoring construction in Philadelphia, ensuring jobs and contracts for its defense–industrial base, and maintaining full control over nuclear fuel supply.

The symbolism is immediate. China sees another encirclement move, North Korea a justification to expand its arsenal. Seoul gains the image of autonomy, but without enrichment or reprocessing rights, the submarine’s heart remains chained to American supply lines.

Annex 1 — HEU vs. LEU: Definitions and Technical Comparison

Annex 2 — Country Case Examples: How HEU and LEU Are Used in Practice

Annex 3 — International Control Framework: NPT, IAEA, and Bilateral Agreements

ASEAN as the New Factory of the World: U.S. Trade Leverage, China’s Erosion, and India’s Missed Turn

The United States is deliberately reconfiguring its trade architecture in Southeast Asia to reduce dependency on China. The new reciprocal agreements with Cambodia and Malaysia—featuring 0% tariff lanes for key products in food, clothing, and shelter—signal not only an economic shift but also a geopolitical realignment. By opening its market to ASEAN agricultural goods, textiles, and housing materials, Washington simultaneously strengthens domestic inflation control and erodes China’s role as the region’s economic anchor.

China, facing internal debt pressures and declining competitiveness in labor-intensive manufacturing, is losing both export volumes and its symbolic position as the indispensable intermediary in U.S. supply chains. Meanwhile, ASEAN consolidates its role as the pragmatic alternative: feeding U.S. households with rice, palm oil, and seafood; clothing American consumers through relocated textile industries; and supplying construction inputs for U.S. housing. This pivot represents a structural rebalancing of global trade with direct impact on CPI, employment patterns, and geopolitical leverage.

Annex Titles

Annex 1 – GDP Profiles and Product Flows under the 0% Tariff Agreement with the United States

Annex 2 – The Real-Economy Impact on China of U.S.–ASEAN 0% Tariff Agreements

Argentina’s 2025 Midterm Elections: A New Balance of Power in Congress

Argentina’s 2025 legislative elections reshaped the political map in ways both predictable and paradoxical. At the provincial level, La Libertad Avanza (LLA) underperformed: entrenched Peronist machines in the North and Radical strongholds in the Center-West retained control, leaving Milei’s movement with little territorial infrastructure. The consensus was grim—without governors, legislatures, or mayors, LLA seemed destined to remain electorally disruptive but institutionally weak.

Yet the national results told a different story. With more than 40% of the vote, LLA became the largest bloc in the Chamber of Deputies, edging Fuerza Patria in Buenos Aires and prevailing in Córdoba, Mendoza, and Santa Fe. The new Congress, seated in December, now counts 112 seats for LLA, 104 for Kirchnerism, 32 for Juntos por el Cambio, and 9 for provincial forces. The Senate renewal further weakened the opposition, making impeachment threats symbolic rather than realistic. Kirchnerism retains discursive power but lacks the numbers to destabilize Milei institutionally.

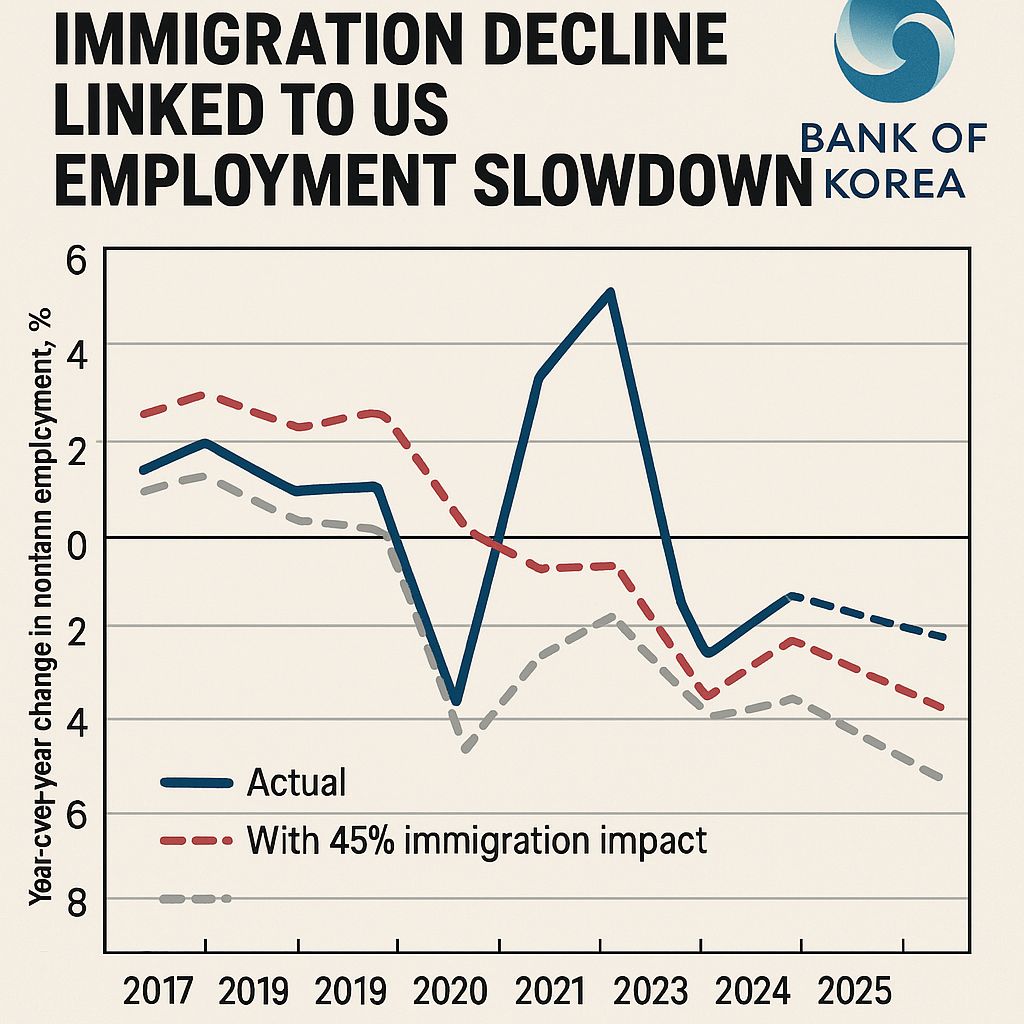

Immigration as Narrative: The Bank of Korea’s Framing of U.S. Labor Slowdown

The Bank of Korea’s latest report attributes nearly half of the U.S. employment slowdown to reduced immigration—a figure not corroborated by any U.S. institution. While the Federal Reserve and other agencies acknowledge immigration as a supply factor, none assign it a precise numerical weight. This selective quantification reveals less about the U.S. labor market than about Korea’s own domestic narrative: immigration is being reframed as an economic necessity, even when the underlying data does not support such certainty.

Annexes

Annex 1 — South Korea: Employment, Immigration, and Crime Nexus (2019–2025)

Annex 2 — Worst-Case Scenario for Korea’s Legislative Elections

India’s Russian Oil Dilemma: Between Trump’s Tariff Pressure and Moscow’s War Revenues

This report examines the structural tension between India’s energy security and U.S. geopolitical pressure, situating Modi’s balancing act within the broader framework of trade, military dependency, and great-power diplomacy. Beyond the Five Laws analysis, the study includes detailed annexes covering the economic and geopolitical foundations of India’s continued reliance on Russian energy.

Annex 1 — Historical Price Variations and Strategic Incentives (2020–2025)

Annex 2 — Geopolitical Drivers of India’s Energy and Defense Policy

Annex 3 — The Korean Defense Channel: Indirect U.S. Armament for India

U.S.–Australia Critical Minerals Deal: Strategic Pivot to Break China’s Grip

On October 20, 2025, the United States and Australia signed a landmark framework to secure critical minerals and rare earths, directly countering China’s tightening export controls. The agreement commits over US$3 billion in near-term investment, positioning Australia as a strategic “friend-shore” supplier and eroding Beijing’s perception of monopoly.

BBIU analysis underscores that China’s dominance is less geological than political—sustained by subsidies, ecological externalities, and coercive policy tools. Without subsidies, “Made in China” loses its artificial cost edge, and price parity emerges for Australia, the U.S., and allied producers. The pact marks the first decisive inversion of leverage: rare earths have shifted from commodity to strategic-security asset.

Annex 1 – Rare Earths: Strategic Dimensions for the Semiconductor Industry

Annex 2 – Strategic Implications for China, U.S., Australia, Japan, and South Korea

Scenario 1 – Prolonged Attrition: Weakening Without Break (with criminal economy variable)

Scenario 2 – Regime Breakdown (CCP Collapse within 24 months)

Annex 3 – Policy & Corporate Recommendations (governments, corporates, subsidy variable)

South Korea’s $350 Billion Dilemma: Between IMF Diplomacy and Trump’s “Upfront” Ultimatum

South Korea’s $350B clash with Washington has shifted from economics to symbolism. Deputy PM Koo Yun-cheol admitted the upfront payment is impossible; Trump insists on it as proof of obedience, mirroring Japan’s capitulation. The trajectory—SPC Trap, Tariff Gamble, Silent Resistance, IMF admission—shows Korea trapped between technical reality and political symbolism. The number is not liquidity, but a test of subordination.

Annex I – Key Missteps by South Korea

Annex II – Structural Constraints & Acceptable Narrative

China’s Robotic Frontier: Western Executives Confront the “Dark Factory” Reality

Western executives visiting China return with an uneasy realization: the country is no longer competing on low-cost labor, but on automation at scale. In 2023 alone, China installed more than 276,000 robots—over half of the world’s total—bringing its operational stock above 1.75 million units. Factories in Shanghai and Shenzhen now operate at near “lights-out” levels, where robotic arms assemble vehicles and electronics with minimal human presence.

Yet behind this futuristic façade lies a fractured social reality. While coastal provinces embrace robotics and AI-driven production, millions of workers in the interior still rely on semi-manual assembly, and rural China remains rooted in labor-intensive agriculture. The result is three Chinas living side by side: one in the 19th century, one in the 20th, and one in the 21st. This temporal inequality is as dangerous as it is striking—an industrial triumph masking a deep social fault line.

Trump’s Retaliation Against China’s Rare-Earth Export Controls and Market Shock

China’s MOFCOM Announcement No. 61 tightens rare-earth export controls and extends them extraterritorially to goods with ≥0.1% Chinese REE content. The U.S. counters: an additional 100% tariff on Chinese imports from Nov 1 (and signals controls on “core software”). Markets slide: Dow −1.9%, S&P −2.7%, Nasdaq −3.56%.

Shock mechanism.

Beijing weaponizes critical materials; Washington weaponizes market access and software. The contest shifts from tariff cycles to choke-point warfare.

Annex 1 — Rare Earths and Semiconductors (Key Points)

Annex 2 — If China levies 100% on U.S. imports

Annex 3 — If the U.S. levies 100% on Chinese imports

BBIU Daily Report — Doha Strike → Peace Pressure: What Changed and What Holds

The September 9 strike on Doha was intended as a show of strength; instead, it marked the unraveling of Israel’s most valuable strategic asset: its narrative of victimhood. Six people were killed, Hamas leaders survived, and within days Netanyahu was forced into an unprecedented apology to Qatar. Washington, scrambling to restore credibility, issued a formal security guarantee to Doha and publicly backed a UN condemnation of Israel’s actions.

For decades, Israel thrived on the perception of being the embattled state under siege. Doha inverted that equation. The image now is of a state willing to bomb an ally’s capital in the midst of mediation—an act that transformed sympathy into suspicion. The apology, the U.S. guarantee, and Trump’s rebuke are not just tactical outcomes; they are structural markers of a shift in leverage. Israel has over-tensioned the rope, and the narrative gravity has snapped.

U.S. Government Shutdown 2025: A Structural Blackout in Economic Signaling

The 2025 U.S. government shutdown is not a fiscal shortfall but a legislative paralysis. Congress failed to authorize spending despite available funds, triggering the furlough of 750,000 federal employees and halting the release of key economic data. This “statistical blackout” blinds markets and policymakers, while globally it undermines confidence in the dollar as the world’s reserve currency. The Executive cannot move money without congressional appropriations; the dysfunction lies in the architecture of governance itself. Far from being cornered, Trump may use this breakdown to argue for a leaner federal state, reinforcing his administration’s narrative that inefficiency must be cut, even if the faucet of government has been shut off at its source.

BBIU Special ReportQuantico → Purge: Our Forecast Confirmed

On September 30, 2025, President Donald Trump and Defense Secretary Pete Hegseth assembled more than 800 generals and admirals at Quantico — an event described by mainstream outlets as a motivational address. Yet BBIU’s forecast, published before October 3, identified it as a tamiz: a filtration mechanism to test loyalty and prepare removals. Within 72 hours, the Pentagon confirmed the dismissal of Jon Harrison, Chief of Staff to the Navy Secretary, following the Senate confirmation of Hung Cao as Under Secretary. This sequence — Quantico → Cao confirmation → Harrison removal — validates BBIU’s scenario methodology, demonstrating forecast-to-reality alignment in record time.

The Quantico Assembly: Trump’s Silent Tamiz of the U.S. Generals

What happened (Sept 30, 2025).

President Trump and Defense Secretary Pete Hegseth gathered ~800 generals/admirals at Marine Corps Base Quantico—a rare, near-unprecedented convocation. Public remarks hammered “standards,” with Hegseth’s now-quoted line about “fat generals,” while reporting noted a tightly controlled, partly closed-door format. ABC News+2Reuters+2

Why it matters.

Form and timing suggest a filtration (tamiz) function: staging loyalty, observing dissent, and preparing ground for personnel reshaping under a more politicized civil–military posture. Independent coverage emphasized the scale/opacity of the meeting rather than concrete policy disclosures. The Washington Post+1

Signal vs. substance.

Vague, discipline-centric rhetoric is the operational feature (not a bug): it projects unity while reserving directives for private channels—useful if the White House pursues controversial moves (domestic deployments, force-structure changes). Follow-on press-access clashes at the Pentagon reinforce the trend toward tighter information control. TIME+1

Annex 1 — Economic Vector (DoD Personnel Shift)

Annex 2 — China–Russia–North Korea Axis (Asymmetry Snapshot)

Annex 3 — U.S.–Israel–Arab Triangle (Coercive Stability

South Korea’s Digital Catastrophe: The NIRS Fire and the Structural Fragility of National E-Governance

Event. A fire at the National Information Resources Service (NIRS), Daejeon disabled 96 core systems and disrupted 647 total, with only 3.9% backed up. Citizens were forced back to fax, mail, in-person requests. Full restoration not expected until late October.

Cause.Expired lithium-ion UPS batteries, flagged in 2024 manuals and inspections, ignited. Critical protocols (battery replacement, segregation, de-energization) were ignored.

Annex I — Structural Problems

Annex II — Immediate Actions (“Accident” Focus)

Annex III — Macro & Reform Agenda

Israeli Strike on Doha: From Counterterrorism to Strategic Self-Immolation

On September 9, 2025, Israeli warplanes bombed Doha, marking the first time Israel struck the capital of a U.S. Major Non-NATO Ally. Six people were killed, including a Qatari security official, while Hamas leaders reportedly survived. The political fallout has been immediate: ceasefire talks collapsed, Arab states convened an emergency summit, and U.S. credibility as Gulf security guarantor was shaken. The silence of American and Saudi defense systems during the strike raised questions of complicity or strategic blindness, further undermining confidence in the existing order. Analysts now warn that the Doha strike may accelerate arms diversification away from the U.S., strengthen momentum for an “Arab NATO,” and embed a new risk premium in global oil markets.

Pharmaceutical Tariffs, Furniture Duties, and Heavy Trucks: Trump’s October 1 Extraction Pivot

President Trump’s October 1 tariffs on pharmaceuticals, furniture, and heavy trucks are not isolated trade measures but enforcement levers within a broader architecture of extraction. The 100% duty on branded drugs reframes the U.S. market as an “invest-or-exit” zone, compelling foreign pharma to localize production. Duties on cabinets, vanities, and upholstered furniture tie directly to construction, symbolically protecting the American household, while the heavy truck tariff links industrial policy to both trucker politics and the advent of autonomous freight.

In contrast, Korea’s $350B “upfront” obligation — compared to Argentina’s liquidity swap relief — highlights a divergence in U.S. treatment of partners: alignment yields concessions, hesitation yields extraction. Domestic propaganda in Seoul frames these developments as nationalist victories, but the reality is structural subordination reinforced through capital, logistics, and healthcare levers.